Bitcoin is a great innovation. It is a decentralized, peer-to-peer electronic currency and payment system all in one. It’s very secure, can be used anonymously, avoids identity theft, and is censorship resistant. Best of all, it passes control of currency away from government and central banks to individuals. We are no longer dependent on governments or their central banks for our currency. Bitcoin avoids dependence on trusted third parties.

However, the systems in place today that enable individuals to obtain bitcoin do not follow these same principals due to the lack of fully decentralized solutions.

Services such as Circle and Coinbase allow you to buy and sell bitcoin, but are regulated. These services enact knowyour-customer restrictions which require you to reveal your identity and record every one of your transactions. Bitcoin exchanges require your funds to flow into and out of exchange owned wallets that are sometimes mismanaged – think Mt.Gox. So while bitcoin is fully decentralized, most established bitcoin related services are fully centralized and designed to be trusted third parties. This effectively removes the intrinsic benefits of the Bitcoin system.

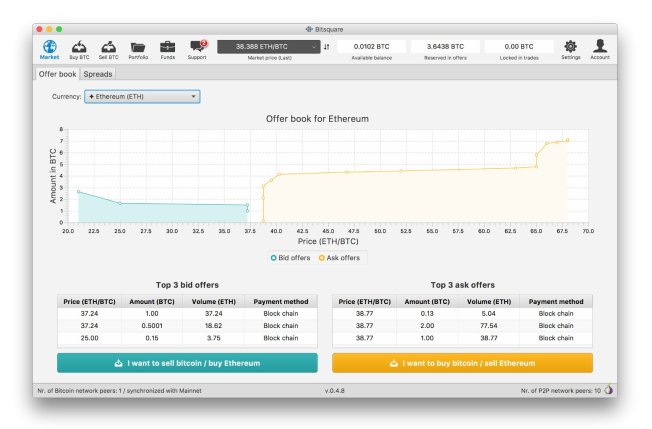

Therefore, I was elated to learn of Bitsquare, an open-source, peer-to-peer (P2P) application that allows anyone to buy and sell bitcoin in exchange to national (fiat) currencies or alternative cryptocurrencies. Unlike existing exchanges, Bitsquare is fully decentralized and censorship resistant using alternative protection mechanisms such as:

- escrow transactions employing 2-of-3 multi-signature addresses

- security deposits to incentivize following the trade protocol

- a decentralized arbitration system to help resolve disputes

Bitsquare protects privacy by using a custom P2P network over Tor, in which every user is a participating node. The Bitsquare platform utilizes an all-in-one desktop application (for Linux, OS X and Windows) providing an intuitive user interface and execution of the trading protocol. Bitsquare users are not forced to reveal their identity, on the contrary, Bitsquare employs Tor to effectively hide the user’s identity.

As the title of this article suggests, Bitsquare is a bitcoin exchange. You can buy or sell bitcoin in exchange for other crypto-currencies or national (fiat) currencies. For example, ether, (the Ethereum crypto-currency) can be exchanged for bitcoin. If you want to buy ether, you sell bitcoin. If you want to sell ether, you buy bitcoin. Bitcoin is always on one side of a trade-able pair. You can’t directly exchange ether for litecoin. If you want to sell litecoin and buy ether, you would first need to convert litecoin to bitcoin. Then go from bitcoin to ether.

I live in the USA and as a result, trading fiat currency with Bitsquare is problematic due to the regulatory resistance to free exchange (Bitsquare will not support methods that enable chargebacks). So my primary interest is in trading crypto-currencies.

I was really excited to hear about the new Decentralized Autonomous Organization (DAO) model popularized by Ethereum and I noticed an opportunity to go beyond crypto-currency exchanges on Bitsquare and to include what I call crypto-equity exchanges as well. Since DAO tokens are similar to equity shares, why couldn’t we exchange DAO tokens for bitcoin using the Bitsquare application? So I contacted Manfred Karrer, the founder and lead developer of Bitsquare, and asked him if he could add The DAO and Maker DAO (MKR) tokens to Bitsquare for trading. This resulted in the release of Bitsquare version 0.4.8 that now supports crypto-currency and crypto-equity trading.

I see this new DAO model as an improvement over the traditional organizational structures formed for investment purposes. How easy is it for someone in the USA to directly purchase common shares in a company based in another country? How many middlemen must one go through to do so? Equity stakes through DAO tokens, provide a much more efficient and effective approach to equity investment on a global basis.

Recently, I noticed a question on The DAO forum where an individual asked: if DAO tokens were held by an exchange, could the exchange then vote those tokens on The DAO proposals rather than the individual who ultimately owns the tokens? This would not be an issue on Bitsquare because the trader/owner never transfers tokens to the exchange. Tokens are only transferred as a result of a change in ownership (the way it should be). Traders actually trade P2P on Bitsquare. This is a first of it’s kind!

Summary of Bitsquare benefits:

- It’s free.

- It’s secure

- It’s open source.

- You don’t have to sign-up.

- You don’t have to reveal your identity.

- Your identity is protected on the network through Tor hidden services.

- There is no transaction trail for anyone (including the IRS) to follow.

- Trading fees are low.

- You always maintain complete control of your funds.

- It provides a fully distributed arbitration system for dispute resolution

Links:

https://bitsquare.io/

https://forum.bitsquare.io/

https://github.com/bitsquare/bitsquare

https://twitter.com/bitsquare_

Article Licence: Creative Commons Attribution 4.0 International License

Is there any CHAIN on which bitsquare is running off? or just the transactions we made goes on the CHAIN and arbitrator then verify that multisig wallet(If buyer and seller 2 of 3 participants of multisig) has agree condition, then security deposits released?