Swisscom is joining Chainlink, the world’s largest oracle network, as part of a pilot initiative. The Chainlink network provides important data for what are known as decentralised financial applications (DeFi), through which transactions worth several billion US dollars are now processed daily, such as on Aave and Uniswap. The rapid growth of this market is giving rise to new types of value chains and business models that could also gain relevance for the Swiss financial market.

Swisscom’s Digital Asset division is responsible for the pilot initiative and for ensuring the operation of what is called an oracle node, which will continuously feed digital asset price data into the Chainlink network. Swisscom is thus assuming an important role as a supplier for rapidly growing decentralised financial applications.

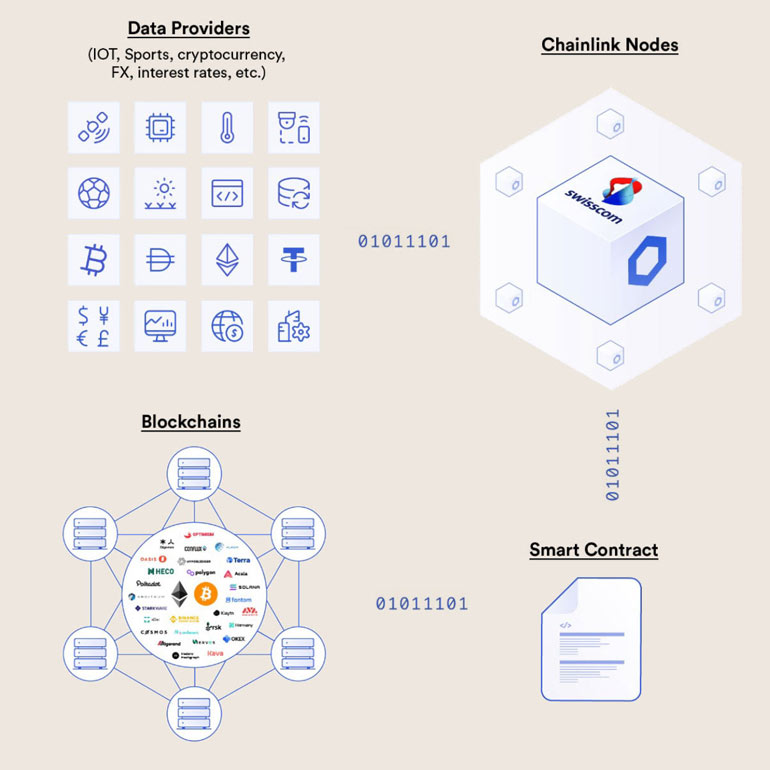

How Swisscom will act as a supplier for decentralised financial applications

In a sense, oracle nodes act as a bridge to off-chain data – currently mainly price data. The Chainlink network aggregates price data from all oracle nodes to produce a robust consensus value. This value can then be used by decentralised financial applications to settle financial contracts. Besides Swisscom, many other technology companies already operate such oracle nodes, including telecom giant T-Systems.

Many of today’s blockchain applications (smart contracts) often require off-chain data, such as price data for a financial contract or weather information for an insurance policy. Oracle nodes continuously feed this data into the Chainlink network, where it is merged and made available in aggregated form for blockchain applications. Since the data originates from many different oracle nodes, the Chainlink network is very robustly secured against failures and issues with individual oracle nodes.

Swisscom believes it is essential to proactively address technological changes in the financial world. After all, it is already one of the largest IT service providers for the Swiss financial industry today. And in order for it to be able to continue offering its customers the best possible solutions in the future, it is important for it to precisely understand the new opportunities offered by the decentralised financial world and make these available to its customers in a targeted manner. Overall, Swisscom’s digital asset team sees no end in sight to the growth of decentralised financial applications. This is especially true in the wake of the increasing shift of transactions, contracts and assets to blockchain-based infrastructures.

Swisscom at the forefront of new financial market infrastructures

Through the pilot initiative with Chainlink, Swisscom is expanding its expertise in the world of decentralised financial applications in order to remain relevant to its customers in this new world and to continue providing high-quality, state-of-the-art technology services as a trusted supplier.

Chainlink

Chainlink is the world’s largest oracle network. The decentralised and globally operating Chainlink network supplies critical data to currently rapidly growing decentralised financial applications, which now manage assets worth several billion US dollars.